how long does the irs collect back taxes

Please dont hesitate to contact us with any questions you may have. As already hinted at the statute of limitations on IRS debt is 10 years.

Millions Of Americans Won T See Their Tax Refunds For Months Time

The IRS generally has 10 years from the date of assessment to collect on a balance due.

. After this 10-year period or statute of limitations has expired the IRS can no. How Long Does The IRS Have To Collect Back Taxes. After a period of 10 years on the statute of limitations the IRS is unable to collect unpaid taxes But there are.

According to Internal Revenue Code Sec. The collection statute expiration ends the. However the exact timing of receiving your refund depends on a range of.

Start with a free consultation. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad Safe and reliable tax resolution services.

Ad The IRS contacting you can be stressful. How far back can the IRS collect unpaid taxes. See if you Qualify for IRS Fresh Start Request Online.

If you need wage and income information to help prepare a past due return complete Form 4506-T. We work with you and the IRS to settle issues. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

Ad Get Your Free Tax Review. The Internal Revenue Service the IRS has ten years to collect any debt. Your tax returns can be audited.

Does IRS audit old tax returns. This is known as the statute of. Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes.

For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. Free Confidential Consult. Ad Owe 10K In IRS Back Taxes.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Start with a free consultation. We work with you and the IRS to settle issues.

As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. Assessment is not necessarily the reporting date or the date on. As stated before the IRS can legally collect for.

If you owe the IRS back taxes you may be wondering if the IRS forgives tax debt. See if you ACTUALLY Can Settle for Less. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD. You can find answers.

After the IRS determines that additional taxes are. Essentially the IRS is mandated to collect your unpaid taxes within. Ad Use our tax forgiveness calculator to estimate potential relief available.

With the Interactive Tax Assistant at IRSgovITA. Schedule a free initial consultation. The IRS 10 year window to collect.

Ad The IRS contacting you can be stressful. Trusted Reliable Experts. 6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual.

Ad Owe back tax 10K-200K. If you need IRS Debt Help Tax Debt Settlements or Tax Debt Advising in Phoenix Mesa or anywhere else Tax Debt Advisors can help. We are experienced tax professionals.

Need help with Back Taxes. Give us a call at 480-926-9300 or fill out. Alternatively you can contact the IRS at 1-800-829.

There are several options here so we will be looking at the best path forward for you. That statute runs from the date of the assessment. Make IRSgov your first stop for your tax needs.

You Wont Get Old Refunds. More than 90 percent of tax refunds are issued by the IRS in less than 21 days according to the IRS. Generally IRS has up to 10 years to collect a liability from the date of assessment.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Need help with Back Taxes. If you have back taxes and you need help in determining the CSED dates for the tax years you owe contact a licensed tax professional.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. Analysis Comes With No Obligation. You May Qualify For This Special IRS Program.

Our Tax Relief Experts Have Resolved Billions in Tax Debt.

How Long Can The Irs Try To Collect A Debt

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

The 2020 Irs Cp14 Guide Tax Attorney Helping You Settle Or Lower Your Back Taxes Stop The Irs Protect Your Bank Wages Today

Irs Says Key Tax Forms Will Be Ready For Tax Season But There S No Start Date Yet

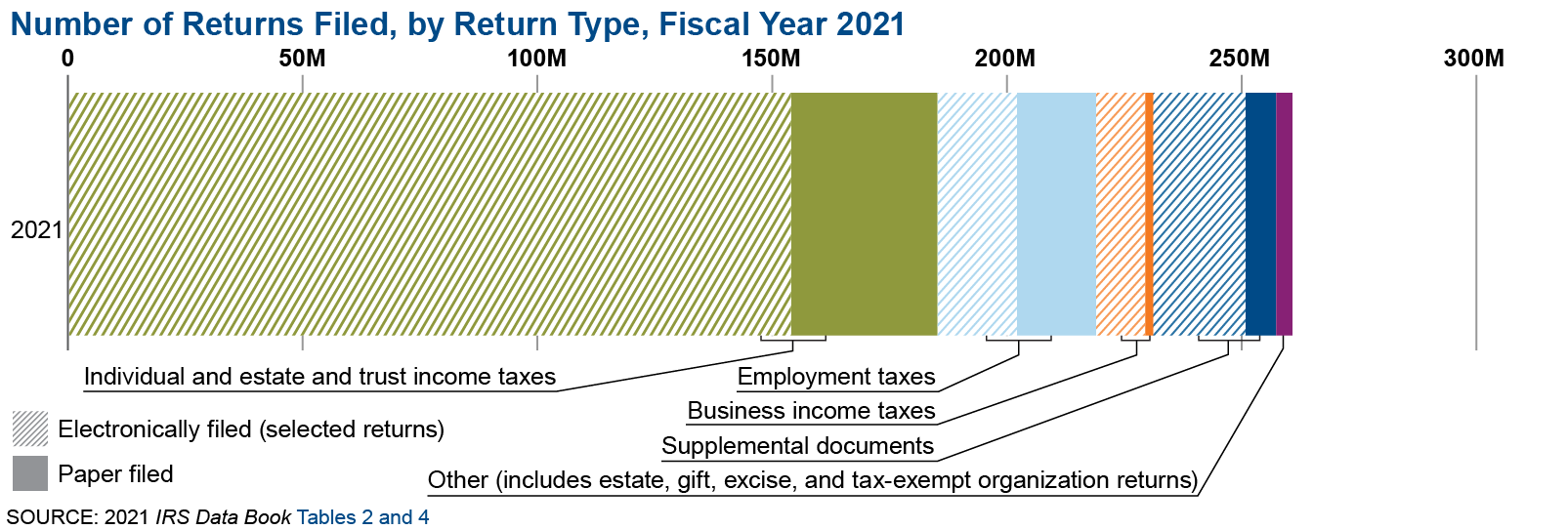

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Asset Seizure What Assets Can The Irs Legally Seize To Satisfy Tax Debts

How Do I Know If I Owe The Irs Debt Om

5 Practical Tips For Dealing With Irs Back Taxes Landmark Tax Group

I Owe The Irs Money What Happens If I Get A Tax Refund

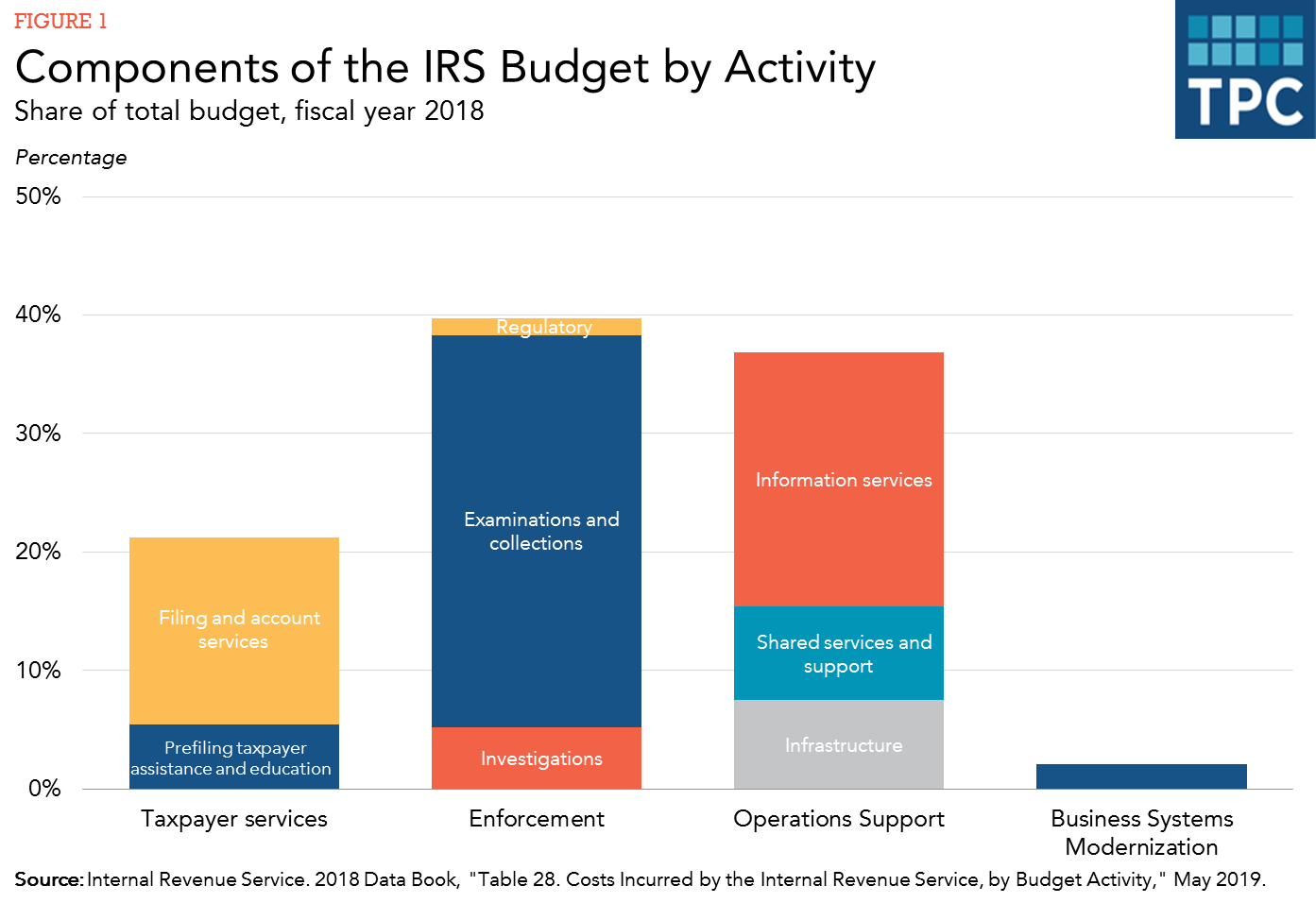

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Can The Irs Take Or Hold My Refund Yes H R Block

How Far Back Can The Irs Go For Unfiled Taxes

Are There Statute Of Limitations For Irs Collections Brotman Law

Know What To Expect During The Irs Collections Process Debt Com